)

Despite Economic Headwinds, Industry Optimistic about 2023 and Beyond

Editor’s note: This article first published in the June 2023 Special Edition of Beyond the Meeting Room, ALHI’s printed magazine, a luxury lifestyle publication focused on sharing compelling, inspirational and educational stories from beyond the four walls of a meeting room.

The word for 2023 and beyond for the hotel industry is optimism.

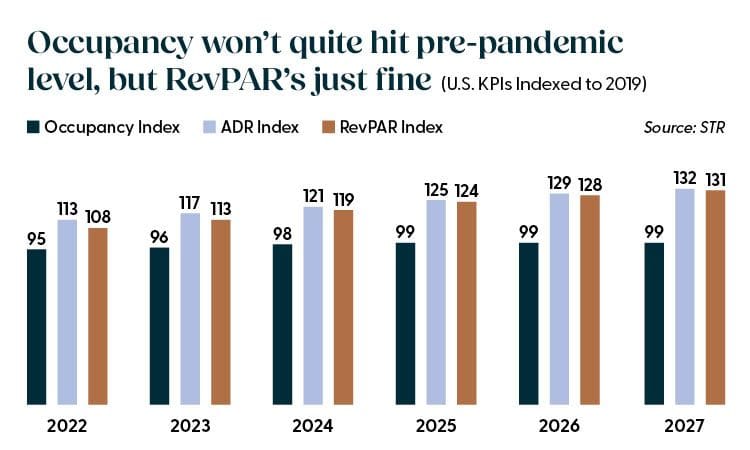

After surviving more than two years of pandemic slowdowns, hotels in the U.S. are seeing growth near 2019 levels, with industry watchers and hoteliers predicting the upward trend will continue for the next few years.

For leisure travelers, it may be the urge for “revenge travel”—the longing to take all those trips that were missed during the pandemic. For business travelers, it’s the desire to get back to doing business and meeting face to face.

“What makes me optimistic is while everything else has slowed down, services—including hotels—remain strong,” said Amanda Hite, President of hotel industry research firm STR. “Forty percent of people who travel are households making $150,000 or more. We also have businesses spending money on getting employees together.”

STR’s third- and fourth-quarter forecast, compiled with Oxford Economics, predicts a recession in the last half of the year. But that shouldn’t affect the hotel industry too much, she said.

“Demand is running right at 2019 levels and higher in some areas of the U.S.,” Hite said. “A lot of that is built on the return of group business. Hotels in the upscale, upper upscale are seeing the return of meetings and it’s where we’ve seen the biggest growth rates. It’s really driving the comeback.”

American Hotel and Lodging Association President and CEO Chip Rogers noted that room revenue projected by AHLA will reach new heights—$197.48 billion vs. $170.35 billion in 2019—but said real revenue increases likely will take several more years.

Why Industry Executives are Optimistic

European Hotels Seeing Steady Recovery

Rogers and Michael Dominguez, President and CEO of Associated Luxury Hotels International, said there is still some bifurcation in recovery between major metro areas and the rest of the United States.

“Metro areas needed international travel and business travel that is just now coming back,” Dominguez said.

Seven of the top 10 markets for attracting foreign travelers to the U.S. will be at or above 2019 levels by 2025 except for Brazil, China and South Korea, according to U.S. Travel Association research. Visitors from Canada and the United Kingdom will exceed 2019 numbers in 2024.

Alex Cabañas, Executive Chairman, Pyramid Global Hospitality in Boston, said although he’s seeing leisure demand in the U.S. begin to plateau, there’s continued acceleration in Europe.

“We are also seeing further recovery of group and business travel demand,” he said. “While both still trail 2019 in terms of demand, the gap is closing and has been more than offset by average rate growth.”

The last area to recover will be China and Asia, Hite said.

“Asia depends on Chinese travelers and recovery is still in early days there,” she said.

State of the Hotel Industry

Key findings from the American Hotel and Lodging Association about the state of the industry and where it’s headed.

- 56% of U.S. adults said they are more likely than they were in 2022 to stay in a hotel. 55% take more frequent trips and 52% said they take longer leisure or vacation trips.

- Hotels are the top lodging choice among 77% of those planning to travel for business. 54% said that hotels are the top lodging choice for leisure trips in the next three months.

- 75% of business travelers whose jobs involve travel are likely to do so in the next three months, compared to 53% in December 2022/January 2023.

- 51% of adults are likely to travel overnight for leisure in the next three months, compared to 36% in December 2022/January 2023.

What’s Hot, What’s Not

Peter Strebel, President of Omni Hotels and Resorts said city destinations have been strong all year. Omni recently opened the $520 million Omni PGA Frisco Resort and Omni Tempe Hotel at Arizona State University.

“The major markets like Dallas, Atlanta, Nashville, Boston and Orlando are popular destinations due to their location, and each offers enriching experiences,” he said. “As we are moving into the summer season, it has been great to see the leisure pace at our resorts, too.”

Cabañas said leisure destinations, particularly in the South, led the industry out of the pandemic. Now there's demand growth in urban and suburban markets.

“In April, some of our best-performing hotels were in Midwest markets including Cleveland, Detroit and Cincinnati,” he said. “Warm-weather leisure markets continue to eclipse pre-pandemic records as travelers have begun to expand their horizons.”

The Caribbean was late to open, Cabañas said, but now his firm is seeing growth there, along with Europe.

“In Europe, we have seen incredible demand. Some of that has been from domestic source markets driven by special events,” he said. “Additionally, we are seeing summer travel demand from the U.S. that will reach record levels.”

And of course, there’s the shining neon star in the desert: Las Vegas.

“Las Vegas is performing extraordinarily well, recording our seventh consecutive quarter of record EBITDAR,” said Bill Hornbuckle, CEO and President of MGM Resorts International.

Florida hotels have had softer demand after last summer, Dominguez said, possibly because the Sunshine State was open last summer while COVID-19 restrictions remained in place as late as last June in California and some other states.

“We have a lot of headwinds, for sure, but the service industry is what continues to drive and surprise. People may have cut back on goods but are still spending on services,” he said.

“I attribute that to COVID revenge travel. People are saying I owe this to myself.”

Meetings Industry Rebound

Hite said that group meetings are returning to more normal levels.

“If you want to get in for 2024, you should have already planned, or you may not get your preferred dates. Meeting planners are now looking for 2025-26,” she said.

Strebel said there is no doubt the meetings industry is recovering, with group leads pushing further into 2024 and throughout 2025.

“Companies are seeing the benefit of face to face for internal and client-facing meetings, and our group business continues to be strong coming out of COVID,” he said. “Convention and large group hotels are performing the strongest.”

At MGM Resorts, Hornbuckle noted that meetings and conventions partly fueled a first-quarter food and beverage revenue increase of 52%, plus banquet spending grew 84% year over year.

Cabañas said Pyramid Global expects group travel to be the fastest-growing segment in 2023, including both guest room demand and food and beverage events.

“From large conventions to small meetings, we are seeing a pace of recovery that is, quite frankly, stronger than we initially anticipated,” he said.

Construction Delays

High interest rates are having an effect on new construction, Hite said.

“In the U.S., the number of rooms under construction really fell,” she said.

“It’s taking longer to get things open. Planning is not growing. Interest rates are so high, along with the tightening of credit, so we feel that is really playing to people sitting on the sidelines.”

Hite foresees no real growth for the next year and half, but there is a silver lining.

“It’s great for existing hotels,” she said. “They don’t have to compete with new rooms.”

Strebel, whose new properties in the pipeline include Omni Fort Lauderdale Hotel and an Omni resort in Pontoque, Mexico, said construction costs are high but seem to be leveling off.

“Finding contractors to bid on work is still difficult,” he said. “Things are getting slightly better than a year ago, but the market is still tight.”

What’s Next

Even with economic headwinds, Hite said the hotel industry is in a good position.

She expects occupancy to grow 1.4% year over year, with demand to grow 2% year over year. The average daily rate will grow by 3-3.5% year over year, she said.

“Even with a recession, the hotel industry will still have growth this year. The reason why is such strong employment. There are more jobs available than people looking for work,” she said.

And she said there’s one final, important reason to be optimistic: “People are still choosing to travel.”

Viva Las Vegas

Las Vegas has long been known for slots, cards, dice and big-name entertainment. But lately, hoops, hockey, football, Formula 1 and NASCAR are vying for visitors' attention. And baseball may not be far behind.

Sports Town, USA? Absolutely, said Bill Hornbuckle, CEO and President of MGM Resorts International.

“2023 really demonstrated how far Las Vegas has come in terms of being a sports town that attracts millions of visitors every month,” Hornbuckle said. “We started the year hosting March Madness games for the first time ever and we’ll be wrapping up the year with the first Formula 1 race in Las Vegas.

“These are crowning achievements for a city that, just a few years ago, didn’t have a single professional sports team.”

Sports has been good for MGM’s Las Vegas properties, helping to fuel seven consecutive quarters of record EBITDAR, Hornbuckle said.

“The quality and consistency of entertainment and sports events in Las Vegas is one of the keys to this transformation into the sports and entertainment capital of the world,” he said.

MGM Resorts played a big role in opening T-Mobile Arena in 2016, which became home to NHL’s Vegas Golden Knights, Las Vegas’ first professional sports team. After that, MGM brought the WNBA to Las Vegas and supported the relocation of the Raiders to Allegiant Stadium.

Lifting the sports betting ban five years ago led to new alliances between the gaming industry and sports.

Here’s just a small sample of the effects from March, according to the Las Vegas Visitor Authority.

Events included the NCAA Sweet 16, NASCAR, Taylor Swift concerts and a big convention month that included the CONEXPO-CON/AGG trade show. Nearly 3.7 visitors came to Las Vegas, a 9.6% increase year over year and nearly equaling March 2019 visitation. Hotel occupancy was above 88%, up 7.7% over March 2022.

But for Hornbuckle, MGM and Las Vegas, that’s just the beginning. The ultimate goals? A Super Bowl and NCAA Final Four.

)

)

)

)

)

)

)

)